Is it worth contributing to a 401k when on an H1B?

Yes, a 401(k) can still be worth it — even if you're not staying long

If you're on a H1B, you might wonder if it's worth contributing to a 401(k), since there's always a possibility that you could lose your status and be forced to leave the US. A common concern is that your money will be locked up for decades, but that's not entirely true.

Early Withdrawal: The Basics

If you withdraw from a Traditional 401(k) before age 59½, you typically face:

A 10% early withdrawal penalty

Income taxes on the amount withdrawn

However, the situation is more favorable than it seems, especially if your employer offers a 401(k) match.

Why the Match Changes the Equation

If your employer offers a 1:1 match, you're getting an immediate 100% return on your contribution — essentially free money. Even if you have to withdraw early and pay taxes and penalties, you're still likely to come out ahead.

Tax Position After Leaving the U.S.

Once you’re no longer a U.S. resident, you're only taxed on U.S.-sourced income. And, if you wait until the year after you move back to withdraw your 401(k), your U.S. income might be zero, which could put you in the lowest tax bracket of 10%.

Plus, if you've cut ties with your state (like giving up your driver’s license, voter registration, and home), you probably won’t owe state taxes either. And don’t forget that you also got a tax break when you first contributed.

Important: Always check if your home country has a tax treaty with the U.S. to avoid double taxation.

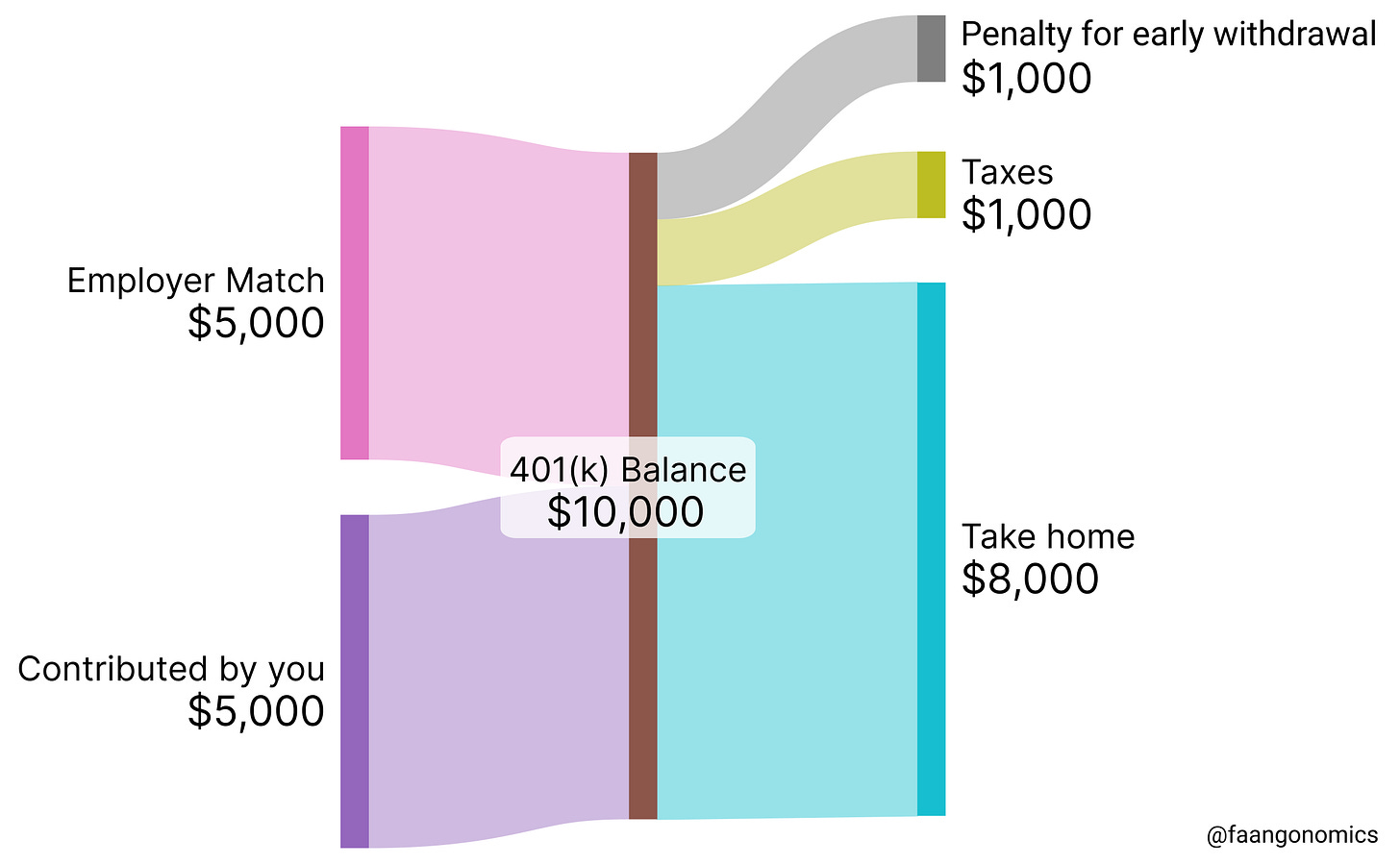

Here’s what that looks like with real numbers:

Let’s say:

You contribute $5,000

Your employer matches with $5,000

You're in a 40% tax bracket, so you get a $2,000 tax break when you contribute

Later, after leaving the U.S., you withdraw the full $10,000:

You pay a 10% early withdrawal penalty = $1,000

You pay 10% U.S. income tax (assuming no other U.S. income and you're in the lowest bracket) = $1,000

You're left with $8,000 on a $5,000 investment — a 60% return, plus the $2,000 in tax savings you received when you contributed.

So, Should You Contribute?

Even if you're unsure how long you'll stay in the U.S., contributing at least enough to get the full employer match in your Traditional 401(k) is typically a smart move.

The employer match is free money

Even if you withdraw early, you’re likely to come out ahead

A Traditional 401(k) gives you an immediate tax deduction, which is even more valuable if you're in a high tax bracket now.

What about Roth 401(k)?

A Roth 401(k) can also be a good option, but only if you’re staying long-term.

You’re likely in a higher tax bracket now than you will be after leaving the U.S., you're paying taxes upfront at a rate that may be higher than what you'd owe later.

If you plan to cash out earlier rather than hold the account long-term, the tax-free growth benefit of the Roth is limited, since your investments may not have had enough time to grow significantly.

Just like with a Traditional 401(k), you’ll still owe a 10% early withdrawal penalty on earnings.

Reminder: Employer match almost always goes into a Traditional 401(k), and is taxable upon withdrawal, even if your own contributions were Roth.