Part 1: 401(k)

A Beginner’s Guide to Retirement Planning (Part 1: 401(k)s)

Why Planning for Retirement Matters

Some of you reading this in your 20s and 30s might wonder if you’ll even make it past your 60s. It might feel like you're dodging disasters on a daily basis—mass shootings, plane crashes, freak accidents. But the truth is, the odds are overwhelmingly in your favor when it comes to living a long life.

In fact, the average 30-year-old woman has a 90% chance of living to age 60. If she makes it to 60, she has an 89% chance of reaching 70, and a 67% chance of making it to 80. For men, the odds are slightly lower: 84% to reach 60, 82% to reach 70, and 54% to reach 80.

By comparison:

Odds of dying in a car accident: 1 in 95 (about a 1% lifetime risk)

Odds of dying in a plane crash: 1 in 11 million (0.00000909%)

Odds of winning the Powerball: 1 in 292 million (0.00000034%)

Yet many people find it easier to buy lottery tickets than save for retirement, even though most of us will live well past 60, and almost no one wins the lottery. And I get it. Retirement feels distant and abstract, while the lottery—no matter how unlikely—feels like it could happen tomorrow. It’s easier to imagine hitting the jackpot tomorrow than picturing yourself at 70.

The reality is, we’re likely to spend nearly as many years retired as we do working. So, granted that we don’t win the lottery, how do we make sure we don’t run out of money?

Let’s start with the basics.

Understanding Retirement Accounts

Retirement accounts work a lot like brokerage accounts. You can invest in stocks, bonds, ETFs, and more, but with major tax advantages:

You don’t pay taxes on interest, dividends, or capital gains annually

Your money grows either tax-deferred or tax-free depending on the account type

That said, retirement accounts also come with a few key rules:

You can’t withdraw your money early (before age 59½) without a penalty, unless you meet special exceptions

You can only put in so much each year

And depending on the account type, there may be income limits or restrictions based on your job situation

But don’t worry—we’ll cover all that as we go.

401(k): Employer-Sponsored Retirement Plans

A 401(k) plan is a retirement account offered through your employer. You can’t open one on your own. Instead, your employer partners with an investment company (such as Fidelity, Vanguard, or Schwab) to manage the plan, and the investments available to you will depend on the options your employer’s plan includes.

When you enroll, your contributions are automatically deducted from your paycheck before the money even hits your bank account. You choose the percentage to contribute (like 5%, 10%, etc.), and that amount is automatically taken out of each paycheck and deposited into your 401(k).

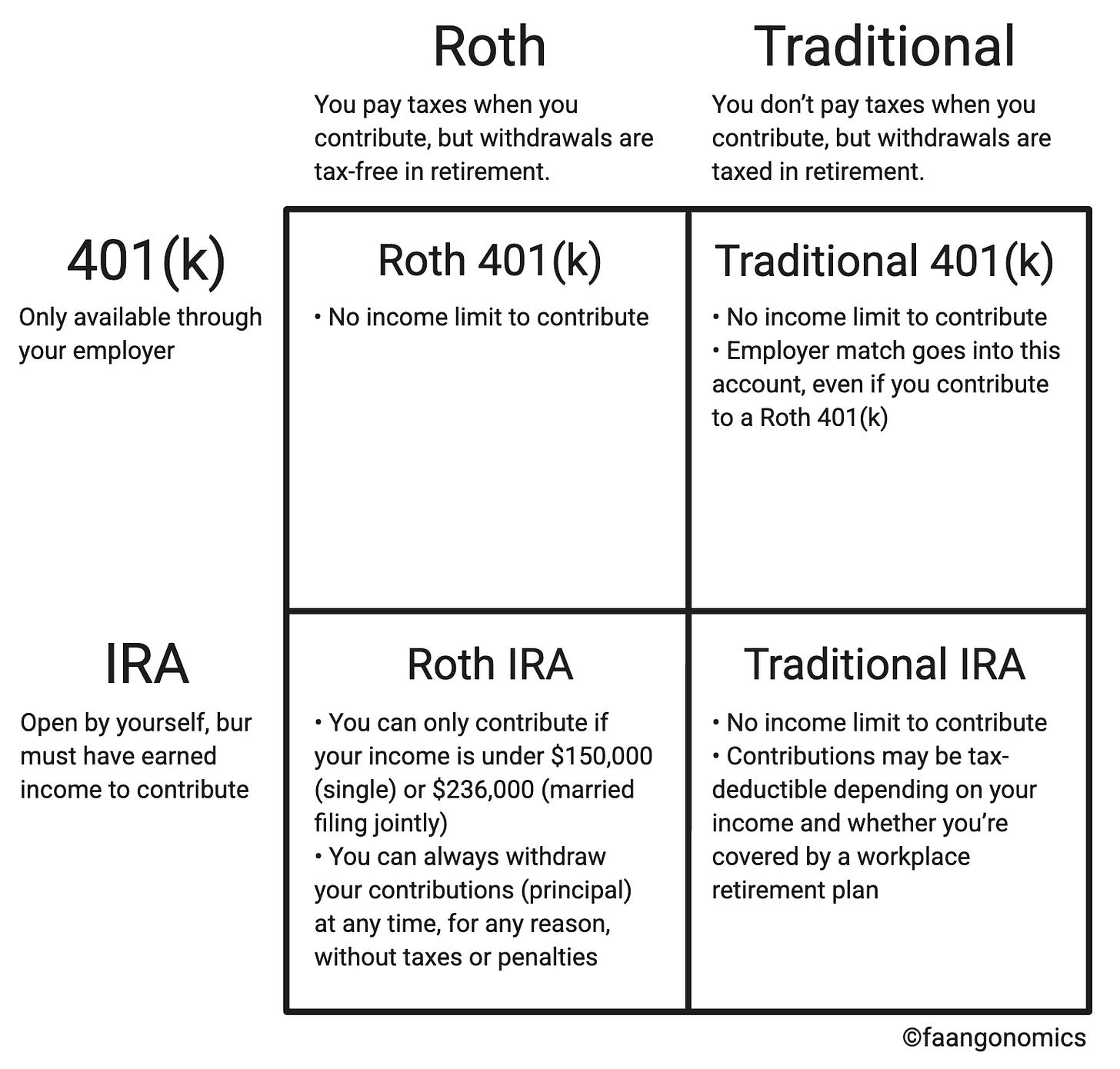

There are two types of 401(k) accounts you can contribute to:

Traditional 401(k): Contributions are made pre-tax, which lowers your taxable income now. You’ll pay income tax later on both your original contributions and any investment growth when you withdraw..

Roth 401(k): Contributions are made with after-tax dollars. You won’t get a tax break now, but all withdrawals in retirement, including your investment growth, are completely tax-free.

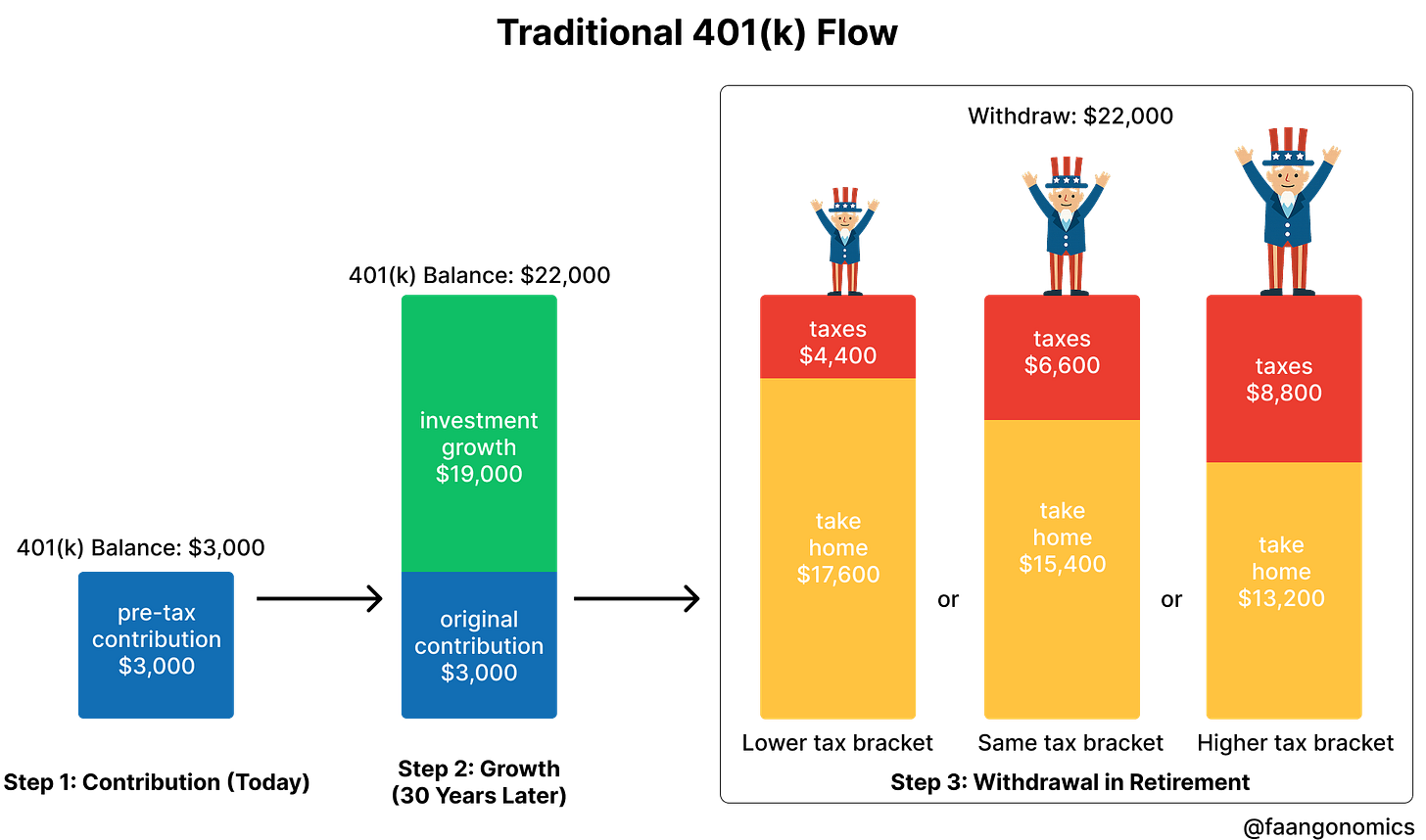

Example: Traditional 401(k)

You earn $3,000 for a paycheck and contribute the entire amount (100%)

Normally, at a 30% tax rate, you’d pay $900 in taxes and take home $2,100

With a Traditional 401(k), the full $3,000 goes into your account tax-free

Over 30 years at a 7% annual return, it could grow to ~$22,000

When you retire, you’ll owe income taxes on the full $22,000

At retirement, if you’re still in a 30% tax bracket, you’d pay ~$6,600 in taxes and take home $15,400

If you're in a lower tax bracket in retirement, you'd keep even more

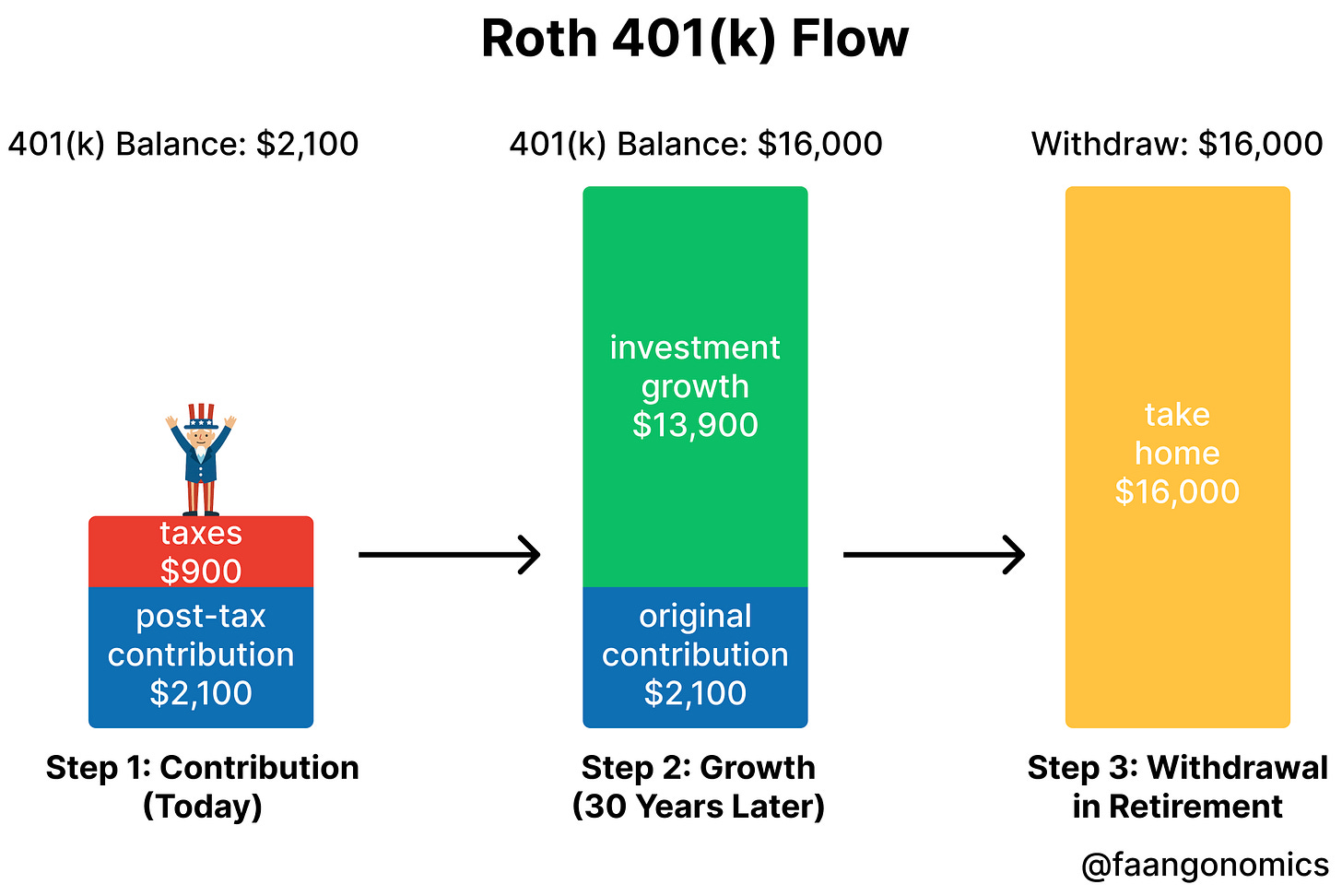

Example: Roth 401(k)

You earn a paycheck of $3,000 and choose to contribute the entire amount to your Roth 401(k)

Assuming a 30% tax rate, $900 is withheld for taxes through payroll, and the remaining $2,100 is contributed to your Roth 401(k)

Over 30 years (assuming a 7% annual return), that $2,100 could grow to about $16,000

When you retire, you can withdraw the full $16,000 tax-free, regardless of your tax bracket at that time

Contribution Limits for 401(k)

Under age 50: $23,500 in 2025

Age 50+: $31,000 (you’re allowed to contribute $7,500 more as a “catch-up contribution”)

You can split contributions between Traditional and Roth 401(k), but the combined total can’t exceed the limit.

Employer Matching: Free Money

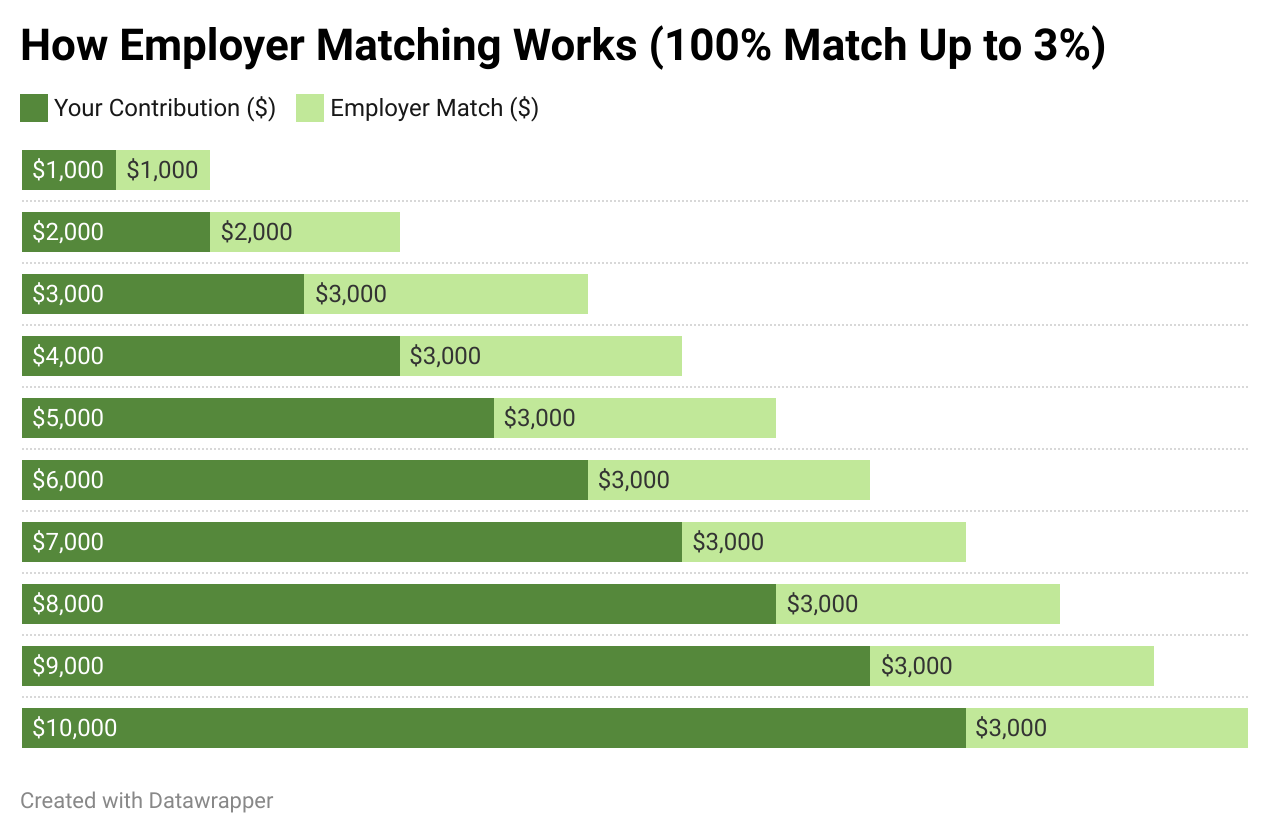

Many companies offer 401(k) matching, and it’s one of the easiest ways to get free money. But not all matches are created equal. Most follow a structure where your employer matches a percentage of what you contribute, up to a limit.

Common Structure: 100% Match up to 3%

Here’s how matching typically works: Your employer might offer a 100% match up to 3% of your salary. That means for every dollar you contribute, they contribute a dollar too—up to 3% of your annual pay.

Example:

Other Structures: 50% Match or IRS Cap-Based

Not all employers offer a 100% match. Here are two common alternatives:

50% Match

Your employer matches $0.50 for every $1 you contribute, up to a certain limit.

Example:

If you contribute $3,000, your employer contributes $1,500, for a total of $4,500 in your 401(k).

IRS Cap-Based Match

Some tech companies base the match on the IRS contribution limit rather than your salary. Instead, it’s tied to the IRS contribution limit. For example, a company might match 100% of your contributions up to half of the annual IRS cap. This means that anyone, regardless of salary, can qualify for the full match.

Example:

If the IRS limit is $23,500, your employer might match 100% of your contributions up to half that amount—$11,750—regardless of your salary.

🔔 Important: Employer matching contributions are typically made pre-tax and go into a Traditional 401(k), even if your own contributions are Roth. The SECURE 2.0 Act of 2022 allows Roth matching, but very few companies have adopted it so far.

💡 Remember: Employer matches don’t count toward your $23,500 personal contribution limit. They’re on top of what you’re allowed to contribute yourself.

Bottom Line

Your 401(k) is one of the most important tools in your financial arsenal. At the very least, you should always contribute enough to get the full employer match. It's free money, and over time, it can make a big difference in your retirement.

Disclaimer:

This content is for informational and educational purposes only and should not be considered financial or investment advice. It does not constitute an offer to buy or sell any securities or financial instruments. Always do your own research and consult with a licensed financial advisor before making any investment decisions. Investing involves risk, including the possible loss of principal.