Part II: IRA

What is an IRA and why you might want one

An IRA (Individual Retirement Account) is a type of retirement account you open yourself. Unlike a 401(k), which is only available through your employer, anyone with earned income can open and contribute to an IRA on their own.

An IRA works similarly to a 401(k). It’s a tax-advantaged account where your investments can grow without being taxed year-to-year, but there are a few key differences:

You open it yourself through a brokerage like Fidelity, Schwab, or Vanguard. (I prefer to use the same brokerage as my 401(k) for simplicity.)

You fund it manually by transferring money directly from your bank account.

The contribution limits for an IRA are lower than those for a 401(k).

Contribution limits for 2025:

Under age 50: $7,000

Age 50+: $8,000

These limits apply to the total contributions made to all your IRAs for the year.

One of the best parts of an IRA is flexibility: you have full control over your investments. You can buy nearly anything you’d find in a regular brokerage account: stocks, ETFs, index funds, bonds, and mutual funds. (There are a few exceptions, like collectibles and some alternative assets, but most investors will find plenty of options.) Personally, I stick with target date funds because it’s simple and effective.

Like 401(k)s, IRAs come in two main types, each with different tax treatments: Traditional and Roth.

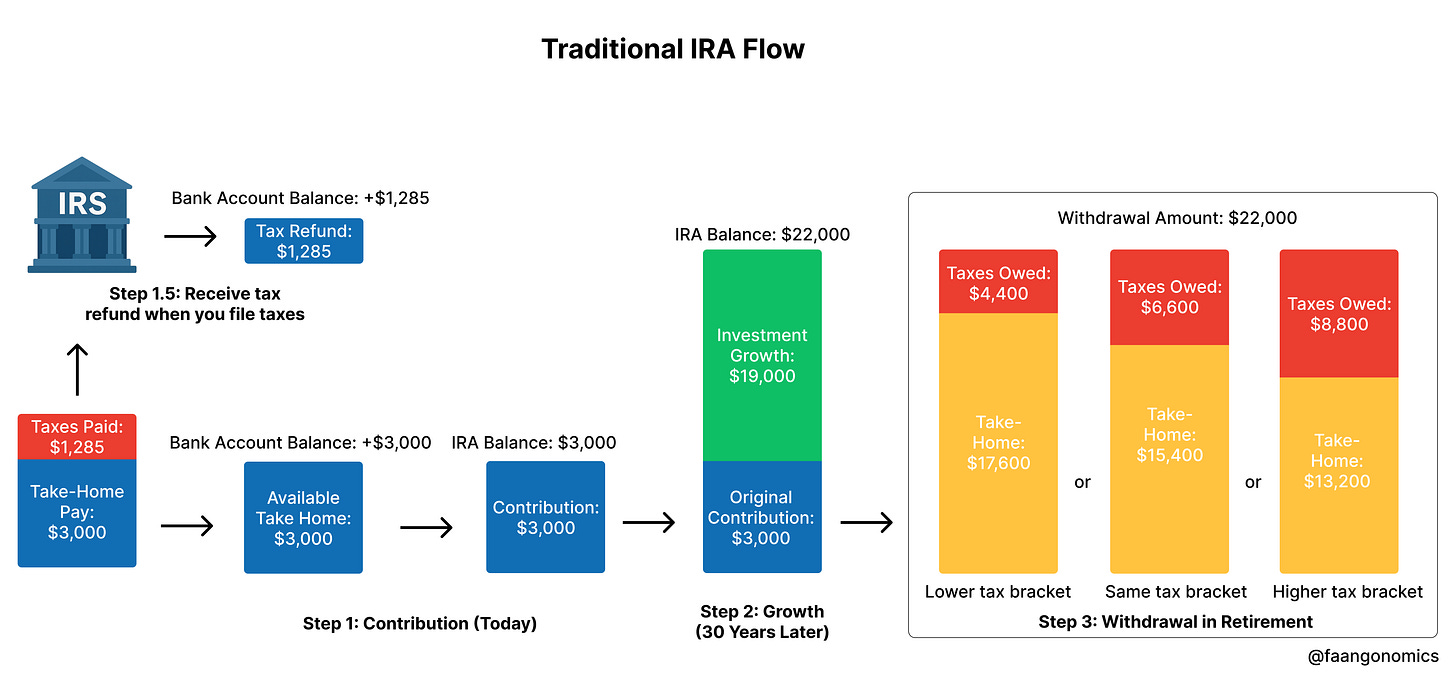

Traditional IRA

Contributions may be tax-deductible, depending on your income and whether you (or your spouse) are covered by a retirement plan at work.

Investments grow tax-deferred.

You’ll pay ordinary income taxes on both contributions and gains when you withdraw the money in retirement.

Example:

You deposit $3,000 from your bank account into your Traditional IRA.

If eligible, you’ll be able to claim a tax deduction when you file your taxes that year. If you’re in the 30% tax bracket, this could reduce your tax bill by about $900.

Over 30 years (assuming a 7% annual return), that $3,000 could grow to about $22,000

When you retire, you’ll owe income taxes on the full $22,000

At retirement, if you’re still in a 30% tax bracket, you’d pay ~$6,600 in taxes and take home $15,400

If you're in a lower tax bracket in retirement, you'd keep even more

Important: Anyone with earned income can contribute to a Traditional IRA, but not everyone will qualify for the full tax deduction. Eligibility depends on your income and whether you (or your spouse) are covered by a workplace plan. The IRS publishes updated income thresholds each year—see this PDF for more details. You can still contribute even if it’s not deductible. Your money will grow tax-deferred and be taxed at withdrawal.

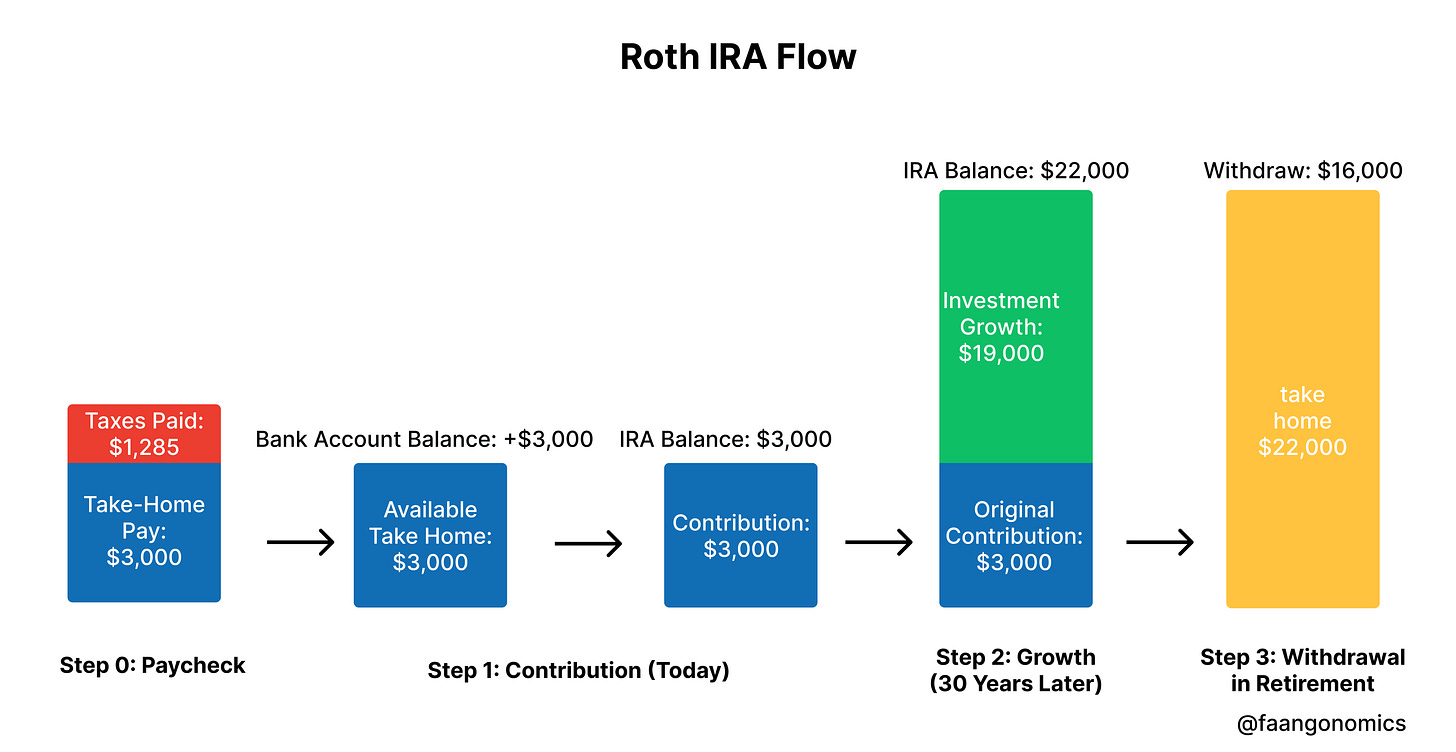

Roth IRA

Contributions are made after-tax — when you contribute money directly from your bank account, it’s money you’ve already received from your paycheck (and paid income taxes on).

Investments grow tax-free

Withdrawals are completely tax-free in retirement

Example:

You deposit $3,000 directly from your bank account into your Roth IRA.

There's no immediate tax deduction because you’re contributing after-tax money.

Over 30 years, assuming a 7% annual return, that $3,000 could grow to about $22,000.

When you retire and withdraw the money, you can take out the full $22,000 completely tax-free.

Important: For a Roth IRA, you can only contribute directly if your income falls below a certain threshold. However, if your income is too high, there’s a way around it using the Backdoor Roth IRA strategy.